What is Lifetime Value and Why MUST your Business know it?

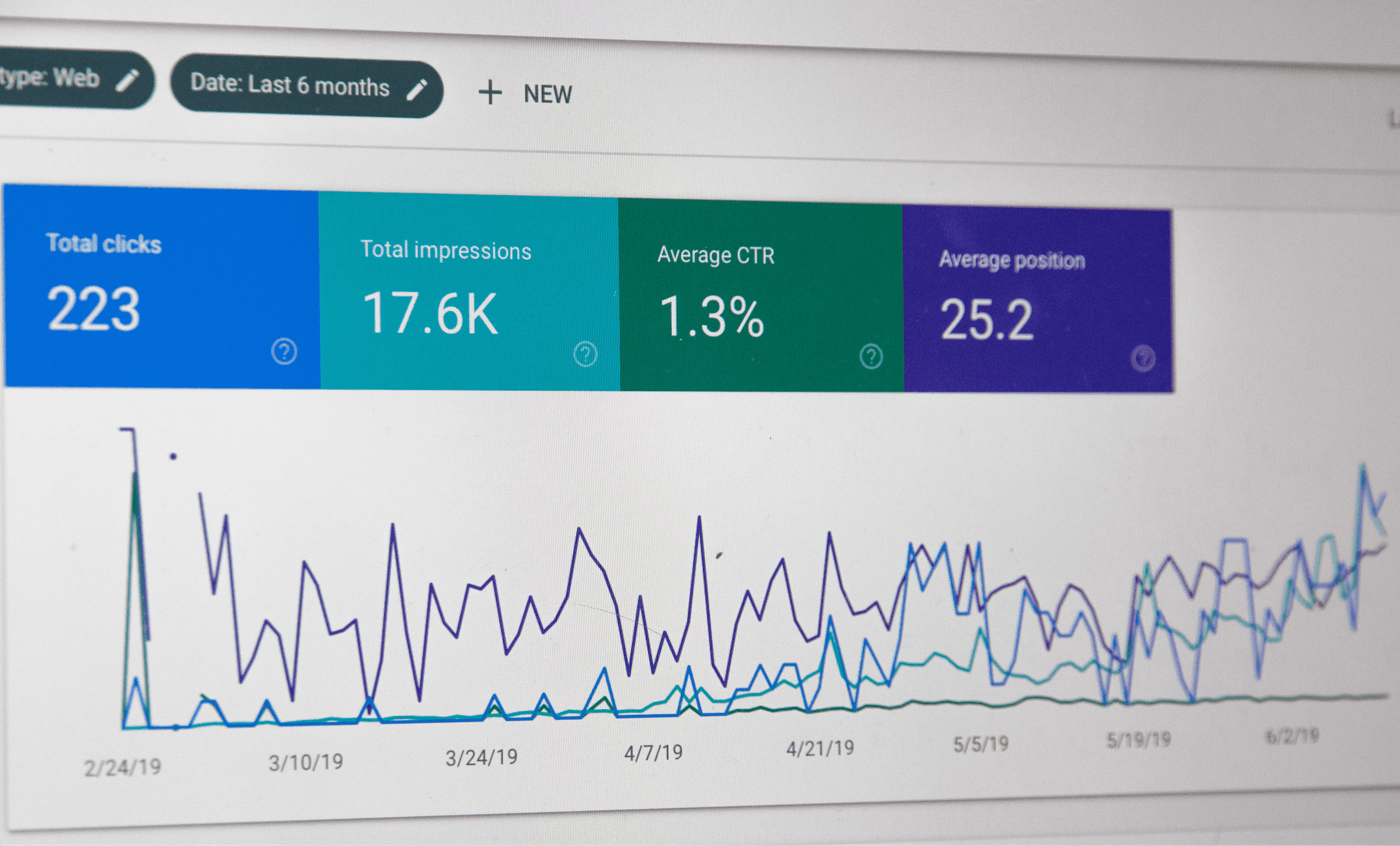

How can you tell that your company is progressing? By looking at revenue, profit margin, sales, or comparing annual projections?

Undoubtedly, all of these metrics can help you to know if your company is succeeding; however, one of the most useful calculations is the less talked about Life Time Value or LTV.

If you are wondering what LTV is and why it’s important your business, keep reading!

What is Lifetime Value?

Lifetime Value is the average revenue that customer will generate throughout their life cycle as a customer. This value will be determined based on several metrics like resources, forecasting, profitability, and marketing budget. It is a key metric especially for subscription based and monthly recurring revenue business models.

In marketing, we consider Lifetime Value as a key factor in determining the monetary worth of a potential customer. In considering how much money you are willing to attain a customer, you should consider LTV, or how much you will profit over the long term with one person as a customer, when deciding how much you should spend on marketing and advertising for each lead or customer purchase. When you’re focused on the long term instead of the short term profit associated with attaining a new customer or client, you are bound to build a more loyal audience.

How Do We Measure LTV?

Lifetime Value is a major variable in revenue forecasting because each customer brings extra revenue every month and throughout their anticipated “lifetime.” As mentioned earlier, LTV can play a big factor in determining the marketing budget of a company. The Customer Acquisition Cost (CAC) is the cost of acquiring a new customer. When you consider LTV, it will help you get a better view of your CAC. Your CAC should be lower than a new customer’s Lifetime Value.

To get more specific, we segment different subsets of customers into groupings based on their CLV or individual Customer Lifetime Value. This will help you to assess which shared characteristics your most valuable customers have and plan how you can focused on acquiring them through marketing.

There are three pieces of information that you will need to know when calculating CLV.

1- Customer Value

This is the value that customer brings in profit to a business in a given period. A customer who spends a large sum is more likely to spend in the future as well. In order to calculate CV, you need to multiply the average purchase value by the buying frequency.

2- Buying frequency

This is the total number of times a customer purchases from in a set time frame. A customer that purchases often from you will certainly come back for more. To calculate purchasing frequency, you need to divide the total number of purchases by the customers for the given time period.

3- Average Buying Value

This the average value that specific group of customers spend every time during check out or invoicing. This can be calculated by divide total sales by the precise number of purchases.

How to Calculate LTV?

Well, calculating LTV depends on the models in which you are doing the business. There is a simple formula to this:

LTV= Number of customer purchases every year X Average purchases value X average duration of customer relationship.

Basically, there are two types of models: subscription model and non-subscription model.

1- Subscription model

This model works on a simple calculation in which we average the monthly amount anticipated from each customer and then divide it by your churn rate. For example: If you are getting $500 revenue from tax service per month and your churn rate is 5% then your lifetime value for a new customer is 500/0.5. This indicates that the expected lifetime of your customers is 20 months.

2- Non-subscription model

This model focuses on the total income you get from new customers include any up-sells, or/and add-ons. This calculated by multiplying Average Order Value by a time of engagement and the number of expected purchases. Therefore, Life Time Value of a customer can either rise or fall over time based on your ability to grow the account.

It is crucial to know that different customers have different Life Time Values, especially when there are different pricing levels for various offerings. In such case, it makes more sense to calculate the LTV for diverse customers based on their pricing segment.

Why Your Business MUST know Lifetime Value?

Every business owner knows that all customers are not equal. Few customers provide more revenue than others. Therefore, it is important to know which category of customers can benefit your business most and maximize it.

For marketers, business owners, and managers, the ability to calculate the worth of their customers is attractive. That’s why LTV is an important and popular term in the business world. It brings a powerful viewpoint to the customer relationships along with acquisition and quantitative precision.

If you don’t use the right information to develop your company, there is no point in knowing the LTV of your best customers. Here are a few ways to use LVT for your business

-Benchmarking

Any successful business knows that lifetime value will determine your future growth and sustainability. This should always grow and improve in value. That’s the foremost the reason your lifetime value should be calculated at least once a year in order to determine your progress.

-Discovering the cost-effective purchase channel

LTV can also be used to segment your customers. One of the best ways to segment them is through a purchase channel. This will direct to channel that is creating the most profitable purchasers and how much buyers are worth from each channel.

-Making decisions based on Investment

When you know the precise lifetime value of your customers, you can examine where you should put your resources, time, and attention to improve the business.

-Locating the profitable customer

This can be done by determining the lifetime value of different demographics such as location, age, gender etc. When you know what your profitable customers look like, you can customize your content and offerings according to their needs.

-Care for your valuable customers

Dealing with customer complaints is a tough job, but with Lifetime Value in mind, you must handle it professionally. When you know what value a particular target group is bringing to the table, it becomes significantly less demanding to excuse the amount that you’ll spend to keep them as clients.

How to increase lifetime value of your company?

No matter how you measure the Lifetime Value of your company, if you are looking to increase it, here are the suggestions you must follow:

-Customer Satisfaction

As an entrepreneur, you must take care of your customers’ happiness. Your Lifetime Value depends on the satisfaction and happiness of your current customers. When you measure customer satisfaction, it will help you to access room for improvement in your company’s strategy.

-Features Special Customers on Social Media

Have you acknowledged when a customer appreciates your business on social media lately? It’s time to show customers some *public* love. People will notice when you highlight them, and they will be more happy to promote your business.

-Provide Them with the Right Motivation

In order to grab the attention of your customers, you need to communicate with them and provide them with attainable products and awards. You can also use free samples to recommend your cross-selling and product trials.

-Invest in Mobile and Web Experience

Your online customers will love your product or service when they find them presented beautifully on your website. Apart from the attractive design, if your website is responsive and loads fast, they will recommend your services or products even more.

Increased customer lifetime value means a growth in profitability, customer loyalty, and marketing allocation. Remember, when you focus on your customers, they are more likely to buy from you.

Wrapping Up the Post

Lifetime Value is important for long term success and growth of your business. It may not be easy to recognize your customers, but if you do so, it’s worth it. So, the best investment you can make is measuring lifetime value of your customers and investing yourself in it. When you know the true worth of your customers, you will make better decision and take your business to new heights.